9 Money Challenges I Overcame (And How)

I’ve faced my fair share of money struggles, but each one taught me a lesson that helped me come out stronger.

- Sophia Zapanta

- 5 min read

There was a time when it felt like no matter how hard I worked, something was always knocking me back financially. Whether it was a surprise medical bill, a period of unemployment, or debt that seemed impossible to pay down, each challenge felt like a mountain I couldn’t climb. One moment that stands out was when Mary and I sat at the kitchen table, staring at overdue notices and wondering how we’d make it through the month. It was humbling and, frankly, scary. But over the years, I learned that facing these money challenges head-on—and coming up with a plan—was the only way forward.

If you’re feeling stuck or overwhelmed by financial obstacles, I’ve been there too. Today, I’ll share nine money challenges I overcame and five specific strategies that helped me get through them.

1. Drowning in Credit Card Debt

Kaboompics.com on Pexels

Kaboompics.com on Pexels

I used to treat my credit card like free money—until the interest rates caught up with me. The monthly payments were brutal, and I felt stuck in an endless cycle of debt. I finally tackled it by switching to a lower-interest balance transfer card and throwing every extra dollar toward my payments. It took time, discipline, and a lot of sacrifices, but becoming debt-free was worth every struggle.

2. Living Paycheck to Paycheck

Kaboompics.com on Pexels

Kaboompics.com on Pexels

No matter how much I earned, I always seemed to be broke by the end of the month. The problem? I wasn’t budgeting—I was just hoping things would magically work out. Once I started tracking every expense and setting clear spending limits, I finally broke free from the paycheck-to-paycheck trap. Now, I make sure every dollar has a job, and my savings actually grow instead of disappearing.

3. Dealing with a Sudden Job Loss

Anna Shvets on Pexels

Anna Shvets on Pexels

Losing my job felt like a financial earthquake—one I wasn’t prepared for. With no emergency fund and bills piling up, I had to act fast. I cut every unnecessary expense, picked up side gigs, and focused on getting back on my feet. That terrifying experience taught me to always have a financial cushion, no matter how secure my job seems.

4. Unexpected Medical Bills

Kaboompics.com on Pexels

Kaboompics.com on Pexels

One hospital visit was all it took to send my finances into a tailspin. I didn’t have enough savings, and the bills felt impossible to pay. I negotiated with the hospital, set up a payment plan, and researched assistance programs to lighten the burden. Now, I never go without health insurance, and I keep a dedicated emergency fund just for medical costs.

5. Letting Lifestyle Inflation Take Over

Oliver Sjöström on Pexels

Oliver Sjöström on Pexels

Every time I got a raise, I spent more—fancier meals, pricier clothes, and a bigger apartment. Before I knew it, I was making more money but saving nothing. I finally stopped upgrading my lifestyle every time my income grew and started saving and investing instead. Keeping my expenses low while my income increased was the smartest financial move I ever made.

6. Falling for Get-Rich-Quick Schemes

Tara Winstead on Pexels

Tara Winstead on Pexels

I once believed I could make easy money through sketchy investments and online “opportunities.” Spoiler: I lost more than I made. After a few painful lessons, I realized that real wealth takes time, patience, and smart decisions—not shortcuts. Now, I stick to proven financial strategies and ignore anything that promises overnight success.

7. Not Having an Emergency Fund

Pixabay on Pexels

Pixabay on Pexels

For years, I thought savings were optional—until a car repair wiped out my entire bank account. That wake-up call pushed me to start building an emergency fund, even if it was just $20 at a time. Slowly but surely, I created a financial safety net that protected me from future disasters. Now, I always keep at least three months’ worth of expenses saved, no matter what.

8. Struggling to Save for Retirement

cottonbro studio on Pexels

cottonbro studio on Pexels

Saving for retirement felt impossible when I was barely getting by. I kept telling myself I’d start “later”—but later never came. Finally, I automated my contributions, even if it was just a tiny amount each month, and watched it grow over time. Now, I know that starting small is better than not starting at all.

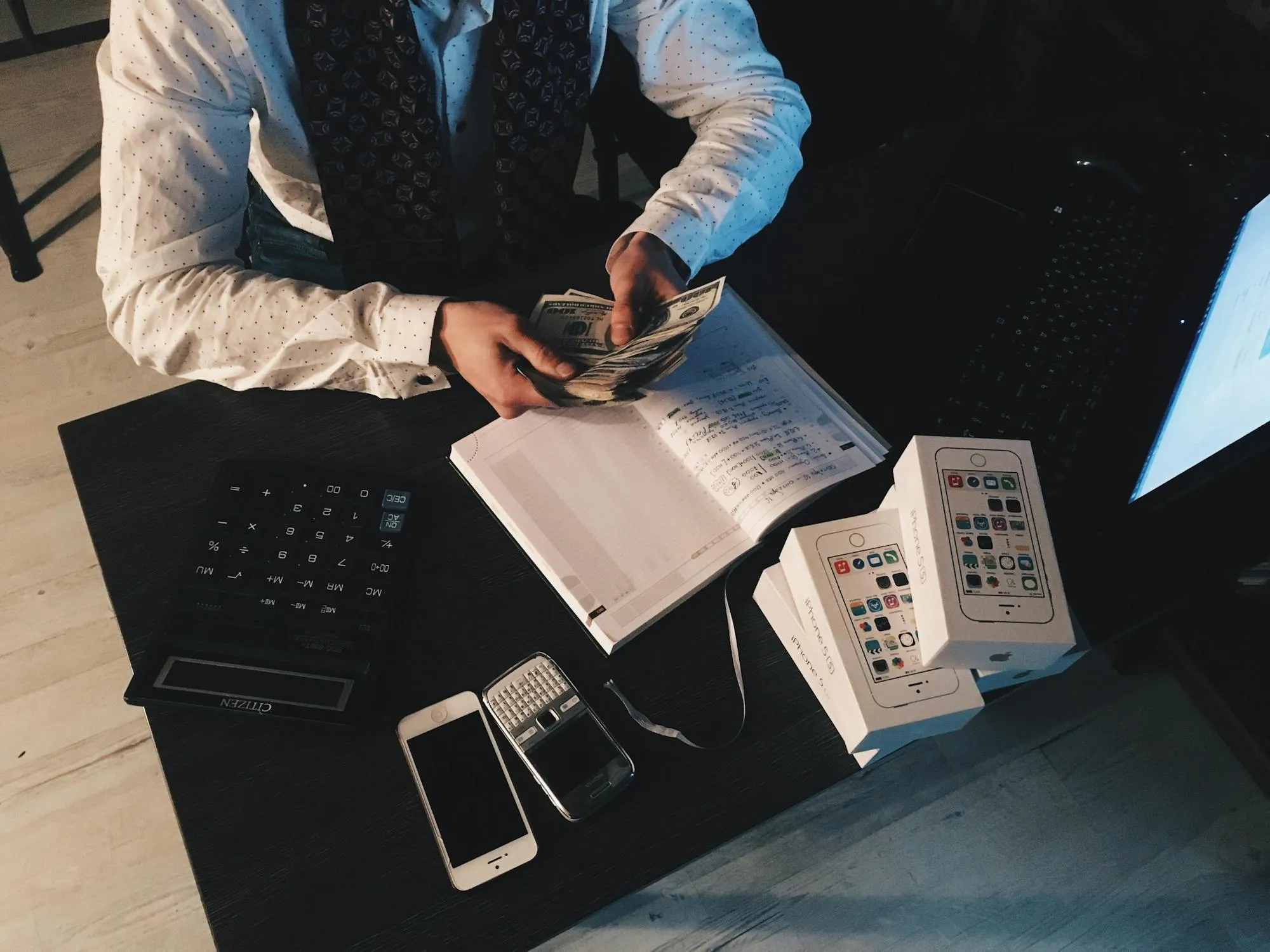

9. Letting Money Control My Life

Kuncheek on Pexels

Kuncheek on Pexels

For years, my financial stress dictated my mood, my decisions, and even my relationships. I constantly worried about money, even when I didn’t need to. It took a mindset shift—treating money as a tool, not a source of anxiety—to finally feel in control. Now, I manage my money instead of letting it manage me, and that has made all the difference.

Looking back, I can see that every challenge taught me something valuable. It wasn’t about avoiding financial problems altogether—it was about how I responded when things got tough. Each hurdle forced me to become more resourceful, disciplined, and focused on the long-term picture. Today, I feel more confident knowing that no matter what life throws my way, I’ve got the tools to handle it. Here’s how you can overcome financial challenges starting today:

Tackle debt methodicallyI focused on paying off one debt at a time, starting with the smallest. That first payoff gave me momentum, and I kept going until every balance was cleared.

Build an emergency fund slowly but steadilyEven when money was tight, I set aside small amounts—$20 here, $30 there—until I had enough to cover unexpected expenses without falling behind.

Cut non-essential expensesDuring hard times, we reviewed every bill and canceled anything unnecessary, like premium TV packages or unused memberships. It freed up extra cash immediately.

Take temporary side jobsWhen my regular income wasn’t enough, I picked up odd jobs like yard work and handyman tasks. It wasn’t glamorous, but it kept us afloat.

Reach out for help when neededAt one point, I worked with a credit counselor to negotiate lower interest rates and create a repayment plan. It made a huge difference in getting back on track.

Challenges are part of life, but they don’t have to define you. Start small, stay determined, and you’ll find your way through. Every step forward counts.