7 Money Conversations I Had with My Spouse

The money talks that brought us closer, reduced stress, and helped us plan for the future.

- Daisy Montero

- 4 min read

Early in our marriage, Mary and I hit a rough patch when it came to money. Bills were piling up, and we found ourselves arguing over little purchases—not because we didn’t care, but because we hadn’t taken time to sit down and get on the same page. One evening after dinner, we finally decided to have an honest talk about our finances. That conversation changed everything.

If you’ve ever felt tension over money in your relationship, you’re not alone. Talking about finances can feel uncomfortable, but avoiding it often leads to more stress. Today, I’m sharing seven important conversations Mary and I had that helped us strengthen our marriage and stay financially sound. Let’s start with five you can have today.

1. How We Combined Our Finances

Thirdman on Pexels

Thirdman on Pexels

Merging finances was not just about numbers; it was about trust and teamwork. We weighed the pros and cons of joint and separate accounts and found a system that worked for us. The key was making sure we felt financially secure while working toward shared goals.

2. Setting Financial Goals as a Team

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

We wanted more than just getting by–we wanted a clear financial roadmap. Discussing short-term and long-term goals helped us prioritize savings, investments, and big purchases. Having a shared vision made money decisions easier and more intentional.

3. The Budgeting System That Works for Us

Vodafone x Rankin everyone.connected on Pexels

Vodafone x Rankin everyone.connected on Pexels

We tried different budgeting methods before finding one that fit our lifestyle. Tracking expenses, setting spending limits, and making room for fun money helped us stay on the same page. Budgeting stopped feeling restrictive and become a tool for financial freedom.

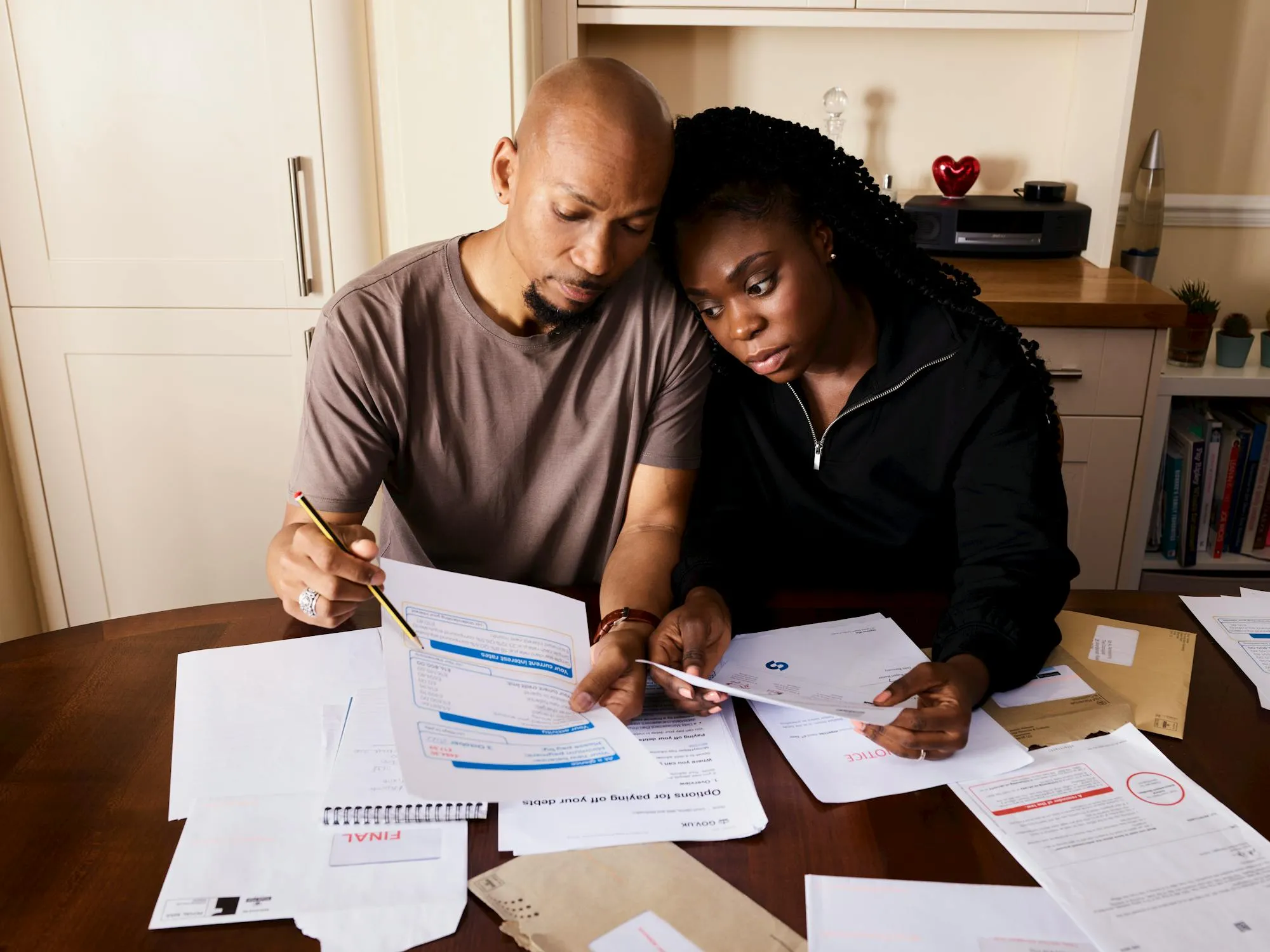

4. Managing Debt Without Stress

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Debt used to feel overwhelming, but talking openly about it helped us take control. We made a payoff plan, prioritized high-interest debts, and avoided blame. Instead of letting debt dictate our lives, we tackled it together with a strategy.

5. How We Handle Unexpected Expenses

Pavel Danilyuk on Pexels

Pavel Danilyuk on Pexels

Life throws financial surprises, and we wanted to be ready. We built an emergency fund and agreed on how to handle unexpected costs. Having a plan gave us peace of mind and kept financial stress from turning into relationship stress.

6. Talking About Investments Without Fear

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Investing seemed intimidating at first, but learning together made it less overwhelming. We discussed risk tolerance, different investment options, and how to grow our wealth. Understanding the long-term benefits helped us feel confident about our financial future.

7. Planning for the Future Beyond Ourselves

Alena Darmel on Pexels

Alena Darmel on Pexels

Our financial talks were not just about us; we also thought about our family and legacy. We discussed insurance, wills, and retirement plans to ensure security in the long run. Preparing for the future made us feel more in control and connected.

Having these conversations wasn’t always easy, but they brought us closer and helped us avoid bigger problems down the line. They gave us a shared vision and clear game plan. Here are five key conversations you can have with your spouse today:

Discuss financial goals: Mary and I sat down and listed what we wanted to achieve—saving for a house, funding the kids’ education, and setting aside something for retirement.

Create a household budget together: We went through every bill and decided how much to allocate to essentials, savings, and fun money, so neither of us felt blindsided by expenses.

Talk about debt openly: Early on, we laid out any debts we each had, from credit cards to car loans, and worked out a strategy to pay them off together.

Decide on big purchases in advance: Before making larger purchases—like furniture or vacations—we agreed to discuss them first, making sure they fit within our budget.

Set up regular money check-ins: Every month, we’d spend 30 minutes reviewing our budget and adjusting if necessary. It kept us both involved and eliminated surprises.

These conversations helped us avoid countless headaches and built a solid foundation. Start the dialogue now, and you’ll feel more connected and in control of your financial future together.