12 Simple Tricks I Use to Save Money Every Month

I’ve found easy ways to cut costs without sacrificing my lifestyle, helping me save money consistently every month.

- Chris Graciano

- 5 min read

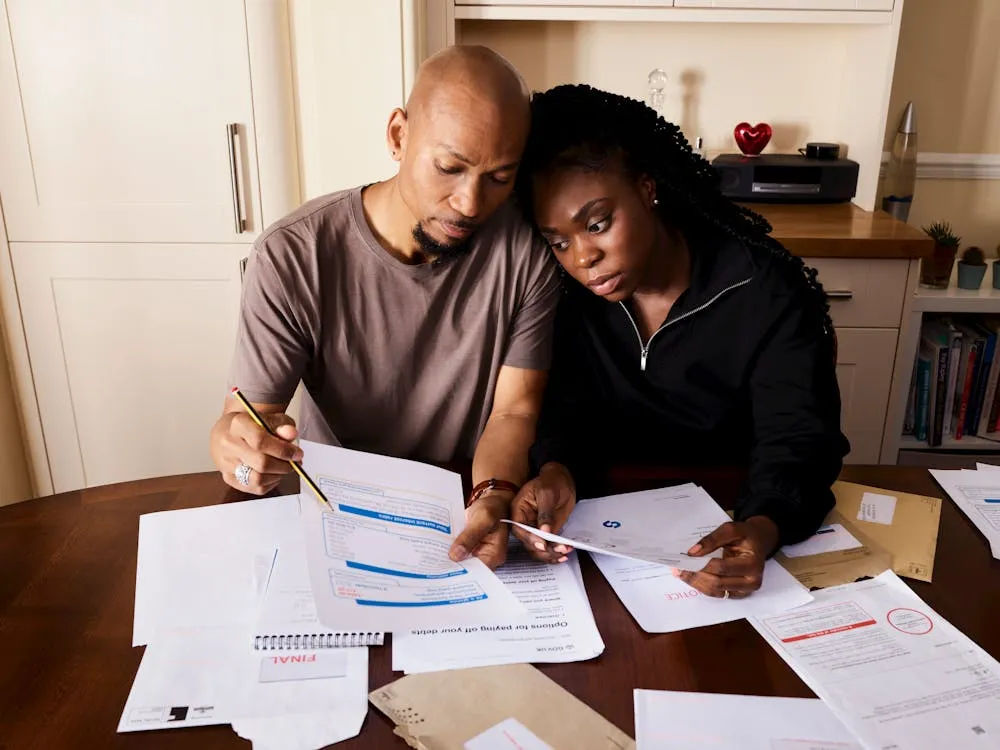

I remember one month when Mary and I sat down after paying the bills and realized we had almost nothing left over. It wasn’t because of big splurges—it was little things adding up. That moment made me take a hard look at our spending habits. I realized that by making small, intentional changes, we could free up more money every single month without sacrificing the things we cared about.

If you’ve ever wondered how to save more without feeling like you’re constantly cutting back, I’ve been there. Today, I’ll share twelve simple tricks I’ve used to keep more money in my pocket, and five you can easily apply right away.

1. Automating My Savings

Andrea Piacquadio on Pexels

Andrea Piacquadio on Pexels

I set up an automatic transfer to my savings account every payday. By treating savings like a fixed expense, I never forget or spend the money elsewhere. Over time, even small amounts add up significantly. Out of sight, out of mind—and into my savings.

2. Cooking at Home More Often

cottonbro studio on Pexels

cottonbro studio on Pexels

Restaurant meals and takeout were draining my budget, so I started meal planning and cooking at home. Not only did I save money, but I also ate healthier.

3. Using Cashback and Rewards Apps

Jack Sparrow on Pexels

Jack Sparrow on Pexels

Before making any purchase, I check for cashback offers or rewards programs. Whether it’s groceries, gas, or online shopping, I earn money back on things I was already buying.

4. Buying Generic Instead of Name Brands

Anna Shvets on Pexels

Anna Shvets on Pexels

I stopped paying extra for fancy labels when store-brand products work just as well. From pantry staples to medicine, generic versions save me a significant amount. Most of the time, the ingredients are nearly identical. The only real difference is the price.

5. Cutting Unnecessary Subscriptions

Vodafone x Rankin everyone.connected on Pexels

Vodafone x Rankin everyone.connected on Pexels

I reviewed my bank statements and realized I was paying for subscriptions I barely used. Canceling streaming services, magazines, and memberships I didn’t need freed up extra cash. If I miss something, I can always resubscribe later. More often than not, I don’t.

6. Shopping with a List

Kampus Production on Pexels

Kampus Production on Pexels

Impulse purchases used to wreck my budget, so now I never shop without a list. Sticking to a plan helps me avoid unnecessary spending. I also compare prices and look for discounts before buying anything. A little planning goes a long way.

7. Using Public Transportation or Carpooling

Guvluck on Pexels

Guvluck on Pexels

Driving everywhere used to cost me a fortune in gas and maintenance. Now, I use public transportation when possible or carpool with friends and coworkers.

8. Negotiating My Bills

Anna Shvets on Pexels

Anna Shvets on Pexels

Instead of accepting high prices, I started calling service providers to negotiate better deals. From internet plans to insurance rates, a simple phone call often led to lower monthly costs. Many companies would rather give me a discount than lose my business. A little persistence pays off.

9. Shopping Secondhand

cottonbro studio on Pexels

cottonbro studio on Pexels

I’ve found incredible deals by buying used instead of new. Thrift stores, online marketplaces, and refurbished electronics offer great savings without sacrificing quality. Many items are barely used and cost a fraction of retail prices. One person’s clutter is another’s treasure.

10. Unplugging Devices to Save Energy

Markus Spiske on Pexels

Markus Spiske on Pexels

I didn’t realize how much “phantom energy” my electronics were using until I made a change. Now, I unplug devices when they’re not in use and switch to energy-efficient appliances. My electricity bill has noticeably dropped. Small habits lead to big savings.

11. Doing DIY Repairs and Maintenance

La Miko on Pexels

La Miko on Pexels

Instead of calling a professional for every small fix, I started learning basic repairs myself. YouTube tutorials have helped me handle things like patching walls, unclogging drains, and even simple car maintenance. Avoiding unnecessary service fees has saved me a lot. A little effort goes a long way.

12. Paying Bills on Time to Avoid Fees

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Late fees and interest charges used to eat into my budget. Now, I set reminders and automate payments to ensure I never miss a due date.

These small shifts made a noticeable difference month after month. It wasn’t about living on less—it was about spending smarter. Over time, they added up to real savings that gave us breathing room. Here are five tricks you can put into practice today:

Meal plan each week: Before grocery shopping, Mary and I would write down meals for the week and make a list. It helped us avoid impulse buys and saved at least $50 a month.

Use cash for discretionary spending: We set aside a fixed amount of cash each week for extras like dining out. Once it was gone, we knew to hold off until the next week.

Cut unused subscriptions: I reviewed all automatic payments and canceled a streaming service and gym membership we hadn’t used in months, saving $40 monthly.

Buy generic brands: Swapping out name-brand items for store brands on essentials like cereal and cleaning supplies knocked another $20 off our grocery bill.

Shop around for better insurance rates: Once a year, I compared car and home insurance quotes and switched providers when I found lower premiums. One year, it saved us over $200.

Start with one or two of these tricks, and you’ll be surprised how quickly the savings add up. The key is consistency—small, smart moves every month can give you the financial flexibility you’re looking for.