12 Financial Goals I Set (And How I Achieved Them)

A break of the financial goals I set for myself and the steps I took to reach them.

- Daisy Montero

- 5 min read

Back when I was younger, financial goals weren’t something I thought much about. I focused on getting through each month—paying bills, covering groceries, and saving whatever was left, if anything. But after a few years of feeling stuck, I realized that without clear goals, we were just treading water. One weekend, Mary and I sat down at the kitchen table and wrote out everything we wanted to achieve, from paying off debt to saving for retirement. That simple act of putting goals on paper gave us direction and made each financial decision feel more purposeful.

If you’ve ever felt like your money is controlling you instead of the other way around, setting clear, achievable goals can make all the difference. Today, I’ll share twelve financial goals I set over the years and how I made them happen—and I’ll break down five you can start working on today.

1. Building an Emergency Fund

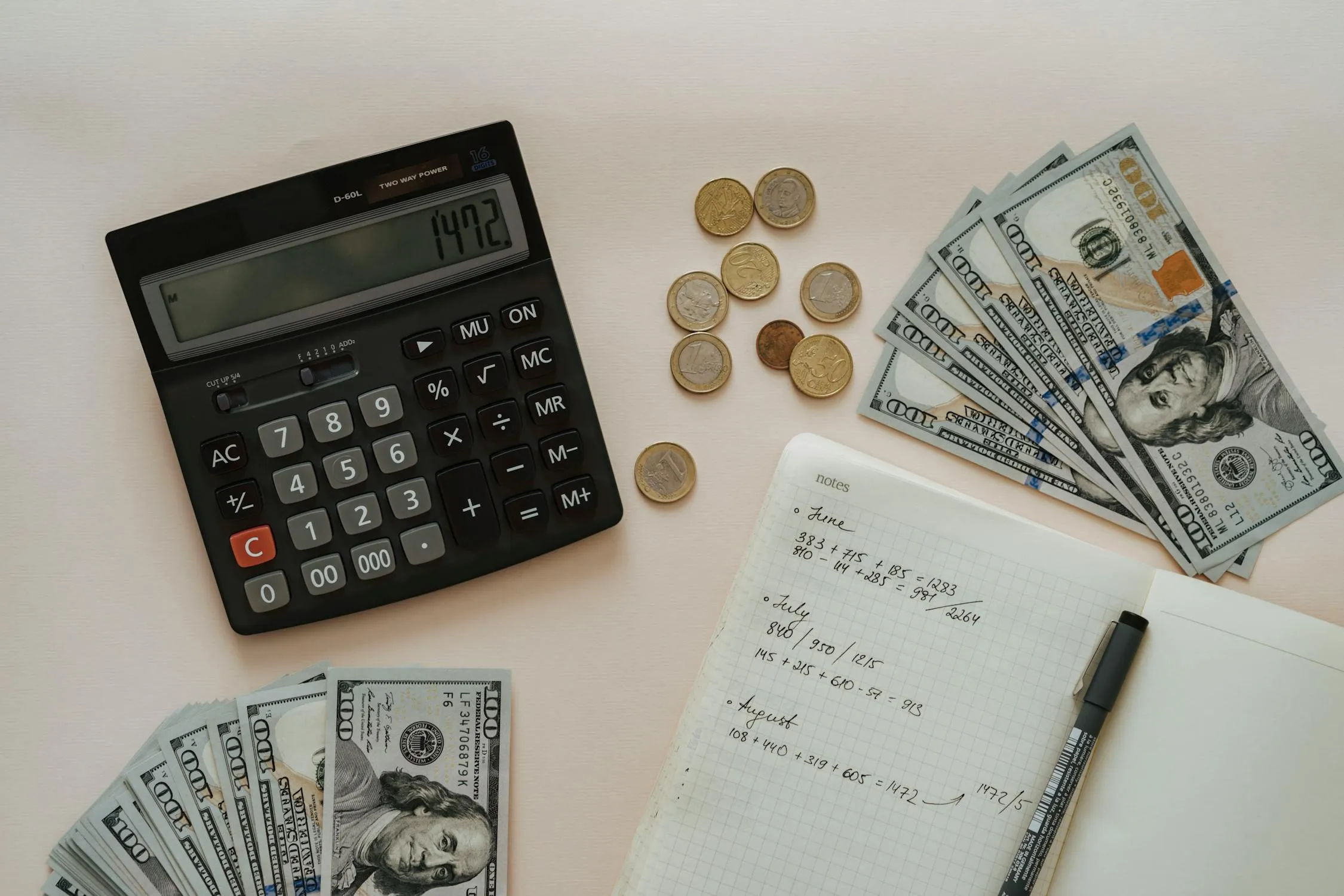

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Unexpected expenses happen when you least expect them. I started when you least expect them. I started by saving a small amount every month, eventually reaching six month’s worth of expenses. Knowing I had a financial cushion made all the difference.

2. Paying Off Credit Card Debt

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Credit card interest was draining my finances, so I made it a priority to pay off my balances. I focused on high-interest debt first while making minimum payments on the rest. Once I saw progress, my motivation skyrocketed.

3. Sticking to a Budget

olia danilevich on Pexels

olia danilevich on Pexels

Budgeting felt restrictive at first, but it gave me control over my money. I tracked every expense, adjusted my spending, and created a system that worked for me. Having a plan made saving and investing much easier.

4. Increasing My Income

Kampus Production on Pexels

Kampus Production on Pexels

Saving is important, but earning more made a huge difference. I looked for side gigs, negotiated a raise, and found ways to turn my skills into extra income. More money meant reaching my goals faster.

5. Investing for the Future

Anna Tarazevich on Pexels

Anna Tarazevich on Pexels

Leaving my money in savings account was not enough. I learned about stocks, index funds, and retirement accounts, then started investing. Time and consistency turned small contributions into big results.

6. Saving for a Home

Kindel Media on Pexels

Kindel Media on Pexels

Buying a home was a long-term goal that required discipline. I cut unnecessary expenses, set a savings target, and automated contributions. When I finally reached my down payment goal, it felt like a huge victory.

7. Funding My Retirement

Photo By: Kaboompics.com on Pexels

Photo By: Kaboompics.com on Pexels

Retirement felt far away until I realized how compound interest worked. I started small, increased my contributions over time, and made sure to take advantage of employer matches. Future me will thank me.

8. Creating Multiple Income Streams

Tony Schnagl on Pexels

Tony Schnagl on Pexels

Relying on one paycheck felt risky, so I built other income sources. I explored freelancing, passive income, and small investments. Having multiple streams made financial setbacks less stressful.

9. Avoiding Lifestyle Inflation

Mike Jones on Pexels

Mike Jones on Pexels

As my income grew, so did the temptation to spend more. I kept my expenses in check by prioritizing savings and sticking to my financial plan. More money did not mean I had to spend it all.

10. Learning to Say No

cottonbro studio on Pexels

cottonbro studio on Pexels

Peer pressure and social expectations can drain your finances. I stopped feeling guilty about skipping expensive outings and focused on what mattered to me. Setting boundaries helped me stay on track.

11. Giving Back Responsibility

Liza Summer on Pexels

Liza Summer on Pexels

I wanted to give back without hurting my financial stability. I set a budget for charitable donations and found ways to contribute my time and skills. Giving felt more meaningful when done with intention.

12. Staying Financially Educated

Mikhail Nilov on Pexels

Mikhail Nilov on Pexels

Money habits can always improve, so I kept learning. I read books, followed financial experts, and stayed updated on new strategies. Knowledge helped me make better decisions and stay ahead.

Looking back, I can say with confidence that setting financial goals was one of the smartest things I ever did. Each goal gave us something concrete to aim for, whether it was getting out of debt or building up savings. It kept us motivated during tough times and gave us a sense of accomplishment every time we hit a milestone. These weren’t grand or flashy goals—just steady, practical steps that added up to long-term financial security. Here’s how you can get started:

Pay off high-interest debt firstI focused on clearing credit card balances before anything else. We tackled the card with the highest rate and worked our way down, freeing up hundreds in interest payments.

Build a three-month emergency fundMary and I set aside a little from each paycheck, no matter how small. Over time, that fund covered unexpected car repairs, medical bills, and other curveballs without derailing our budget.

Max out retirement contributions annuallyOnce we had basic savings in place, I increased my 401(k) contributions every year. It wasn’t a huge jump each time, but consistency made the difference.

Create a sinking fund for large expensesWe opened a separate account for things like holiday gifts, home maintenance, and vacations. That way, big expenses didn’t sneak up and throw us off.

Set clear financial milestonesInstead of vague goals like “save more,” we picked specific numbers—like saving $10,000 for a new car—and tracked our progress every month to stay motivated.

Start small, stay focused, and watch how quickly you can turn financial stress into financial strength. Each step forward is one step closer to the stability and freedom you’re working toward.