12 Creative Ways I Saved for Big Expenses

I needed to save for big expenses without feeling broke, so I got creative—and it actually worked.

- Sophia Zapanta

- 6 min read

I’ll never forget when our old washing machine gave out unexpectedly. I stood in the laundry room staring at the puddle on the floor, knowing full well there wasn’t a “washing machine fund” sitting in our bank account. It wasn’t the first time something big crept up on us—a car repair, school fees for David and Emily, or a much-needed home upgrade. Back then, we didn’t have a lot of wiggle room, so saving for large expenses felt impossible. That’s when Mary and I decided we needed to get creative, finding ways to tuck away extra money without feeling like we were depriving ourselves.

If you’ve ever wondered how to cover life’s bigger costs without stress, you’re not alone. Today, I’ll share twelve creative strategies we used to save for big expenses—and five practical ones you can start applying right away.

1. I Opened a “Can’t Touch This” Savings Account

Nataliya Vaitkevich on Pexels

Nataliya Vaitkevich on Pexels

I knew if I kept my savings in my regular account, I’d spend it “accidentally.” So, I opened a separate savings account, gave it a ridiculous name like Vacation Fund 3000, and made it slightly annoying to access. Out of sight, out of mind—and out of reach for impulse purchases. The harder it is to touch, the easier it is to grow.

2. I Rounded Up Every Purchase

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Every time I spent money, I rounded up to the nearest dollar and tossed the extra into savings. A $4.60 coffee? I moved 40 cents. A $22.75 dinner? I saved 25 cents. It felt like pocket change, but over time, those little bits added up to a surprisingly nice chunk of cash. Turns out, spare change isn’t so “spare” after all.

3. I Did a “No-Spend” Challenge (And Made a Game Out of It)

Kaboompics.com on Pexels

Kaboompics.com on Pexels

For one month, I only bought essentials—no random Amazon purchases, no unnecessary snacks, no “just because” shopping. I kept a tally of what I would have spent and moved that amount into savings instead. It felt like I was competing with myself, and honestly, winning was pretty satisfying. At the end of the month, I had way more saved than I expected (and realized how much I spent on dumb stuff).

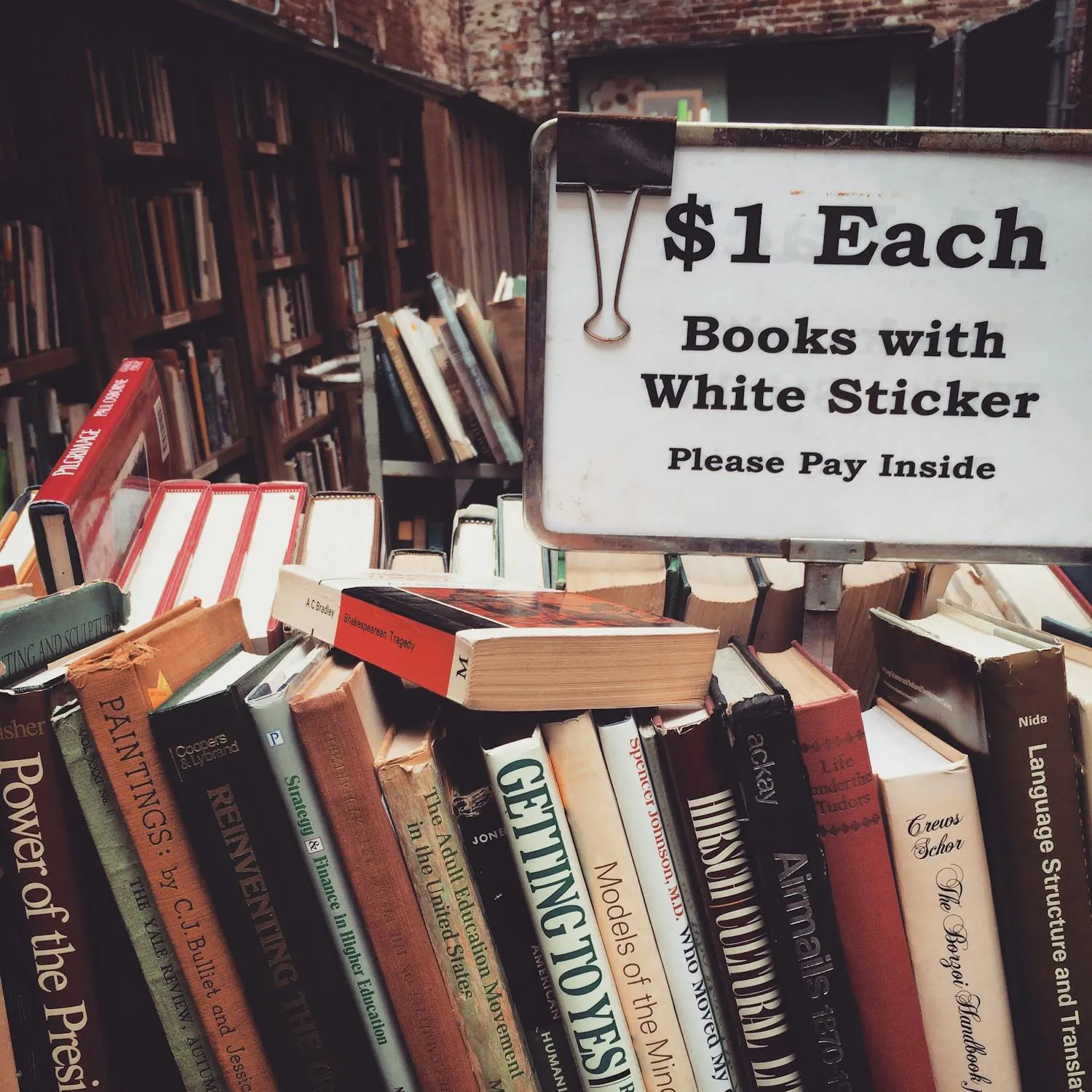

4. I Sold Stuff I Didn’t Use

Sasha P on Pexels

Sasha P on Pexels

I looked around my home and realized I was basically living in a storage unit of forgotten items. Clothes I never wore, gadgets collecting dust, old books—I listed them all online and turned my clutter into cash. Not only did I make money, but my space felt way better too. Turns out, minimalism is profitable.

5. I Cashed in on Credit Card Rewards

Kindel Media on Pexels

Kindel Media on Pexels

Instead of letting my credit card points sit there like decoration, I actually used them. I redeemed them for travel, gift cards, or even straight-up cashback. It felt like getting free money for things I was already buying anyway. Best part? I never carried a balance, so I wasn’t paying interest—just collecting perks.

6. I Made Saving Automatic

Pixabay on Pexels

Pixabay on Pexels

I set up an automatic transfer to savings every time I got paid—before I even saw the money. It was like a secret tax I imposed on myself, except this tax actually made me richer. Since I never had to think about it, I never had an excuse to skip it. And since I only spent what was left, my budget adjusted naturally.

7. I Took on a Fun Side Hustle

Kaboompics.com on Pexels

Kaboompics.com on Pexels

I wanted to boost my savings without touching my main income, so I picked up a low-stress side gig. Whether it was freelance work, selling art, or even dog sitting, every dollar went straight into savings. It felt good to have an extra stream of income dedicated entirely to my goal. Plus, making money outside of my day job felt weirdly empowering.

8. I Switched to Cash-Only for Fun Spending

Pixabay on Pexels

Pixabay on Pexels

For non-essentials like eating out or entertainment, I withdrew a set amount of cash each month. Once it was gone, that was it—no sneaky credit card swipes. Seeing physical money leave my wallet made me way more aware of what I was spending. Funny how watching a $20 bill disappear feels way worse than tapping a card.

9. I Hacked My Grocery Shopping

Jack Sparrow on Pexels

Jack Sparrow on Pexels

I stopped shopping without a plan and started meal prepping like a pro. No more buying things I thought I might need, only to throw them out a week later. I also started using cashback apps and store rewards, which made saving money feel like a game. Less waste, less spending, and somehow, better meals? Win-win-win.

10. I Turned My “Wants” Into Rewards

RDNE Stock project on Pexels

RDNE Stock project on Pexels

Instead of impulse-buying things I wanted, I turned them into savings goals. If I wanted a $100 pair of shoes, I had to save twice that amount—half went to the shoes, and half went into my savings. This trick forced me to really think about my purchases and made saving feel just as satisfying as spending. Spoiler: I ended up skipping a lot of unnecessary purchases.

11. I Used the “30-Day Rule” for Big Purchases

Bich Tran on Pexels

Bich Tran on Pexels

If I wanted to buy something expensive, I had to wait 30 days before actually buying it. Most of the time, I either forgot about it or realized I didn’t actually need it. If I still wanted it after a month, I knew it was a smart purchase, and I planned for it. My wallet thanked me, and my home wasn’t filled with regret.

12. I Asked for Help (And Got Free Money)

Michael Burrows on Pexels

Michael Burrows on Pexels

I stopped being too proud to look for discounts, negotiate bills, or apply for cashback offers. A quick phone call lowered my internet bill, a loyalty program gave me free perks, and asking for price matches saved me a bunch on big purchases. Turns out, companies want to keep customers happy if you just ask. Free money is the best kind of money.

Over the years, these small but intentional strategies helped us prepare for everything from new appliances to family vacations. It wasn’t about cutting back to the bone—it was about being mindful, resourceful, and always keeping an eye on the bigger picture. Looking back, it feels good knowing we met those expenses without going into debt or sacrificing our peace of mind. Here’s how you can do the same:

Create a separate savings account for big expensesWe opened a special account labeled “Home & Family Needs.” Every month, even if it was just $50, we funneled money into it specifically for upcoming large purchases.

Set automatic transfers on paydayInstead of waiting to see what was left at the end of the month, we set up automatic transfers to savings the day our paycheck hit, treating it like a fixed bill.

Use windfalls wiselyWhenever we got a tax refund, work bonus, or unexpected gift, we put most of it straight into savings rather than spending it.

Sell unused items around the houseOnce a year, Mary and I would declutter—selling old furniture, tools, and clothes online. Not only did it clear space, but it added extra cash to our savings pot.

Plan no-spend weekendsEvery month, we’d choose one weekend to avoid eating out, shopping, or unnecessary spending. The money saved went directly toward our bigger savings goals.

Saving for life’s big costs doesn’t require a drastic overhaul—just a few intentional changes and a bit of consistency. Start small, stay focused, and you’ll be ready when those big expenses inevitably roll around.