10 Mistakes I Made with Money (And How I Fixed Them)

I made plenty of financial mistakes, but learning from them helped me take control of my money and build a more secure future.

- Chris Graciano

- 4 min read

I can still remember the first big financial mistake I made. I bought a brand-new car right after getting my first steady job. It felt like a reward at the time, but I didn’t realize how quickly that loan payment, insurance, and maintenance would eat into my paycheck. That decision kept me tight on cash for years.

If you’ve ever looked back and thought, “I wish I’d handled that differently,” you’re in good company. I’ve made plenty of money mistakes over the years—but the key was learning from them and making changes. Today, I’m sharing ten mistakes I made, how I fixed them, and five you can correct starting today.

1. Ignoring a Budget

Kaboompics.com on Pexels

Kaboompics.com on Pexels

For years, I spent without tracking where my money was going. It felt like I had no control over my finances until I finally created a budget.

2. Relying Too Much on Credit Cards

cottonbro studio on Pexels

cottonbro studio on Pexels

I treated my credit card like free money and paid the price with high interest. Carrying a balance month after month drained my finances. I fixed this by paying off my cards aggressively and only using them for planned expenses. Now, I use credit wisely and never let debt pile up.

3. Not Building an Emergency Fund

Kaboompics.com on Pexels

Kaboompics.com on Pexels

When unexpected expenses hit, I had nothing to fall back on. This led to borrowing and unnecessary stress. I made it a priority to save at least three months’ worth of expenses. Having a financial cushion gives me peace of mind.

4. Overspending on Non-Essentials

Kaboompics.com on Pexels

Kaboompics.com on Pexels

Impulse purchases and lifestyle inflation kept my bank account empty. I used to justify small splurges, but they added up quickly. Now, I track my spending and prioritize what truly matters.

5. Delaying Retirement Savings

Engin Akyurt on Pexels

Engin Akyurt on Pexels

I thought I had plenty of time to save for retirement, so I kept putting it off. The result? I missed out on years of compound interest. Once I realized my mistake, I started contributing regularly to my retirement accounts. The earlier you start, the better.

6. Ignoring My Credit Score

RDNE Stock project on Pexels

RDNE Stock project on Pexels

I never checked my credit report and assumed my score was fine—until I was denied a loan. It turned out that small mistakes, like late payments, had hurt my credit. I fixed it by paying bills on time, lowering my debt, and monitoring my score regularly. Good credit opens doors.

7. Not Negotiating My Bills

Antoni Shkraba on Pexels

Antoni Shkraba on Pexels

For the longest time, I paid whatever amount companies charged me without question. Then I learned that many bills—like internet, insurance, and even medical expenses—are negotiable. A few phone calls saved me hundreds of dollars a year. Now, I always ask for a better deal.

8. Making Only Minimum Payments on Debt

Mikhail Nilov on Pexesl

Mikhail Nilov on Pexesl

I thought I was managing my debt just fine by making the minimum payments. In reality, I was barely covering the interest, and my balances never seemed to shrink. I fixed this by making larger payments and using the snowball method to eliminate debt faster. Less debt means more financial freedom.

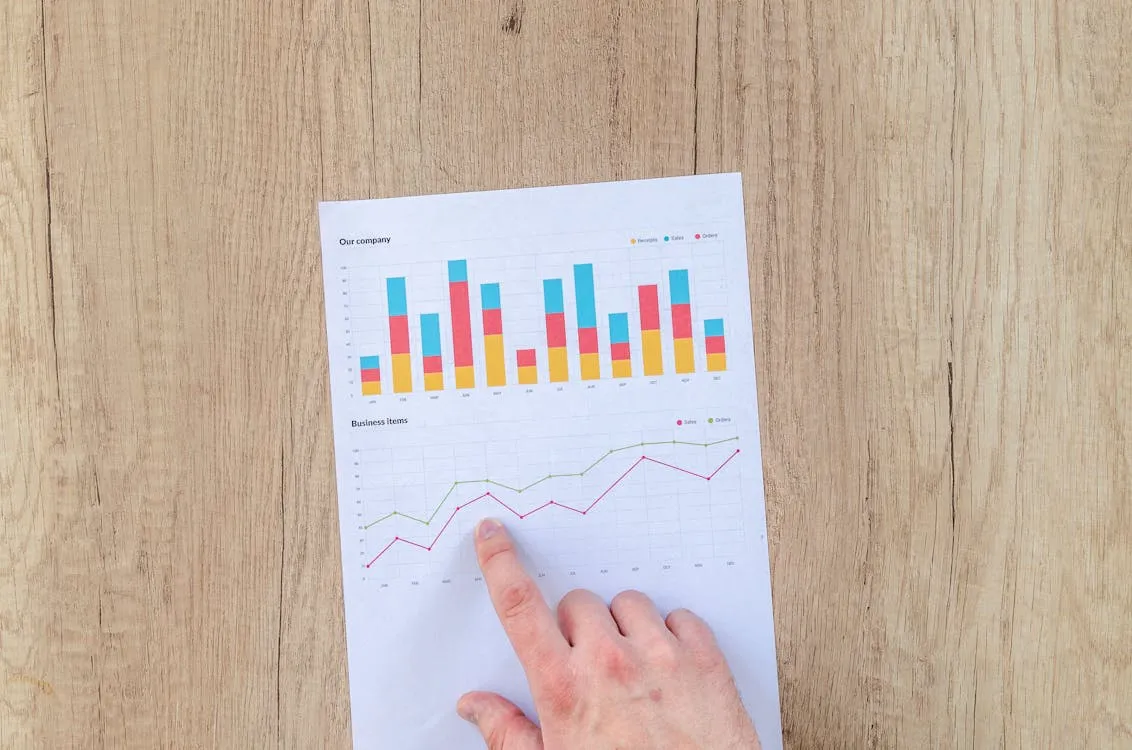

9. Not Investing Early Enough

Lukas on Pexels

Lukas on Pexels

I was afraid of the stock market and left my savings sitting in a low-interest account. By the time I started investing, I had already lost valuable years of growth. Now, I contribute regularly to index funds and let compound interest do the work. The best time to invest was yesterday; the second-best time is today.

10. Not Setting Financial Goals

Kaboompics.com on Pexels

Kaboompics.com on Pexels

For years, I just went with the flow, never thinking about long-term money plans. Without clear goals, my finances felt directionless. Once I set targets—like saving for a house and becoming debt-free—I stayed motivated and made smarter financial choices. Having a plan changed everything.

Each mistake taught me something valuable. The fixes didn’t happen overnight, but steady effort turned things around and helped me avoid repeating them. Here’s how you can take action today:

Avoid buying new cars on credit: After that first mistake, I switched to buying reliable used cars with cash or low-interest financing, saving thousands over time.

Stick to a clear budget: I used to wing it each month, but sitting down with Mary and writing out a budget helped us avoid overspending and plan better.

Build an emergency fund early: For years, I didn’t have one. Once I started setting aside just $25 from each paycheck, I was ready when unexpected expenses hit.

Avoid carrying credit card balances: I learned to treat my credit card like cash—only charging what I could pay off in full each month to avoid interest.

Prioritize retirement savings early: I waited too long to contribute to my 401(k). Once I automated contributions, I took full advantage of compound growth, even if I started smaller than I should have.

Mistakes are part of the journey. What matters is how you fix them. Start applying one or two changes today, and you’ll be on a stronger path moving forward.